In this in-depth FBS Standard account review, we will explore its key features, such as its flexible leverage options, a wide range of tradable assets, and a user-friendly trading platform. Additionally, we will delve into the advantages of this account, including tight spreads, fast execution, and a host of educational resources to support traders in their journey.

Whether you are new to trading or a seasoned professional, this review will provide valuable insights to make an informed decision about FBS Standard Account.

What Is The FBS Standard Account?

The FBS Standard account is a trading account offered by FBS, a well-known global forex broker.

It is a very flexible trading account that is a good option for beginners only starting on the trading path and also suits more experienced traders with higher demands.

Features Of The FBS Standard Account

| 🏅Feature | FBS Standard Account |

| 💰 Minimum Deposit | $1 / R 16 ZAR |

| 💵 Floating spreads | from 0.7 pips |

| 💸 Commission | Zero-commission trading |

| ⚖ Leverage | 1:3000 |

| 🧾 Open positions | Max 200 |

| 🚀 Order volumes | from 0.01 up to 500 lots, with 0.01 steps |

| 📅 Market execution | from 0.3 seconds, straight-through processing (STP) |

| 📱 Platform | MT4, MT5, FBS Trader |

| 🌐 Trading Instruments | 36 Forex pairs, 8 metals, 3 energies, 11 indices, 127 stocks, 5 crypto pairs |

| ☑ Open Account | 👉 Click here |

- Flexible Leverage

The FBS Standard account offers flexible leverage options ranging from 1:1 to 1:3000, allowing traders to amplify their potential profits while managing their exposure to risk. This flexibility is especially beneficial for traders who have different risk tolerance levels or trading strategies.

- Wide Range Of Tradable Assets

Moreover, the FBS Standard Account offers a wide range of tradable assets, including major currency pairs, commodities, indices, and cryptocurrencies. This diverse selection allows traders to diversify their portfolios and take advantage of various market opportunities.

- Trading Platforms

FBS offers the widely recognized MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms for the Standard Account. These platforms are known for their user-friendly interfaces, advanced charting capabilities, and extensive range of technical analysis tools.

Traders can also enjoy the convenience of mobile trading through the FBS mobile app, available for both iOS and Android devices.

- Spreads and Commissions

The FBS Standard Account operates on a spread-based system, meaning that traders pay the difference between the bid and ask price for each trade. The spreads can vary depending on market conditions but generally start from 1 pip. FBS does not charge any additional commissions on standard accounts, making it cost-effective for traders.

How To Open The FBS Standard Account

Opening a Standard account is easy. Simply follow these steps.

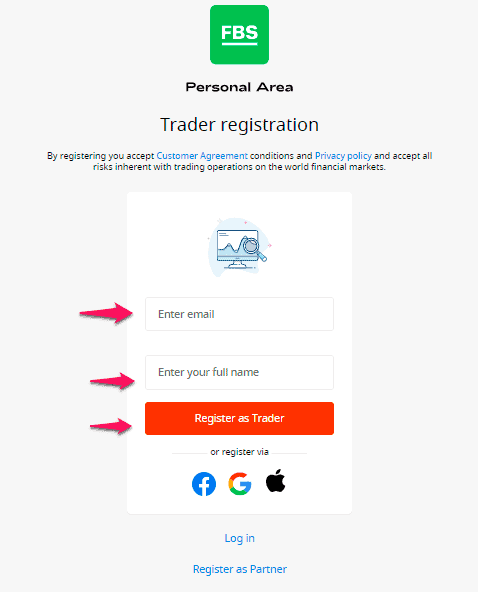

- Click here to go to the FBS account registration page.

- Enter your email and full name and click on ‘Register as trader‘

- Verify your email and proceed to set up your account. Choose the trading platform you want between mt4 & mt5. Select your account currency and preferred leverage. Then click on ‘ Open Account ‘

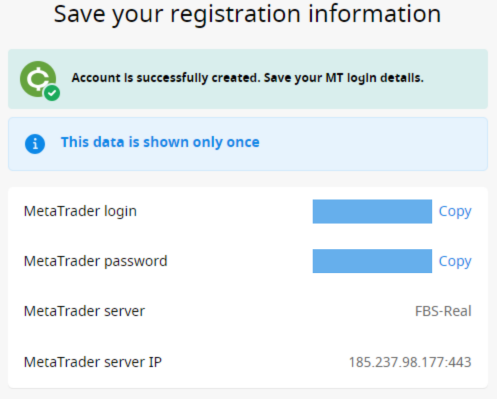

- Save your Standard account login details after they appear on the screen. These details will be shown only once so make sure you save them somewhere safe to avoid challenges when you want to log in.

- Deposit funds and download your trading platform. Log in using the credentials you saved in the step above. Upload your account verification documents and then start trading.

FBS Standard Account Fees & Commissions

FBS Standard Account comes with competitive fees. The account does not charge any additional commissions on trades, and the fees are included in the spreads.

This means that traders can focus on their trading strategies without worrying about additional costs eating into their profits. The tight spreads offered by FBS Standard Account ensure that traders get the best possible prices for their trades.

It's important to note that while FBS Standard Account offers competitive trading costs, traders should be aware of potential overnight fees or swap charges for holding positions overnight.

These fees vary based on the instrument traded and market conditions. It is advisable for traders to familiarize themselves with the relevant fees and charges before engaging in overnight positions.

FBS Standard Account trading conditions

The FBS Standard Account offers competitive trading conditions that ensure a seamless trading experience. The account allows for both instant and market execution, giving traders the flexibility to choose the execution method that suits their trading strategies.

With instant execution, orders are executed at the price displayed on the trading platform, while market execution ensures orders are executed at the best available market price.

The account also supports hedging and scalping strategies, giving traders the freedom to implement their preferred trading techniques.

FBS Standard Account customer support

Our FBS Standard Account review found that FBS provides excellent customer support to assist traders with their queries and concerns. The platform offers 24/7 customer support through various channels, including live chat, email, and phone.

The multilingual support team ensures that traders from different regions can communicate effectively and receive prompt assistance.

Traders can rely on the FBS support team to provide assistance with account-related inquiries, technical issues, and general trading questions.

Whether you need help with navigating the trading platform or understanding specific trading features, the FBS support team is dedicated to providing timely and helpful support to ensure a smooth trading experience.

Pros & Cons Of The FBS Standard Account

Pros

– Leverage up to 1:1000 and zero commission.

- Low minimum deposit

- Access to a wide range of trading assets

- Quick and easy account funding

- Excellent customer support

- Mobile trading via the FBS App

Cons

- High leverage may amplify losses

- Higher spreads than other account types

- No Rand Base currency for South Africans

Conclusion: Is FBS Standard Account the right choice for you?

In conclusion, this FBS Standard Account review found that the account offers a solid foundation for traders looking to participate in the dynamic forex market with the support of a reputable broker.

It has a range of features and advantages that make it a compelling choice for traders. With its flexible leverage options, a wide range of tradable assets, and a user-friendly trading platform, the account caters to the needs of both beginner and experienced traders.

The tight spreads, fast execution, and educational resources further enhance the trading experience and support traders in their journey.

However, it's important to note that every trader has unique requirements and preferences. Before opening an FBS Standard Account, consider your trading goals, risk tolerance, and desired trading strategy.

A major drawback of the FBS Standard account is that it doesn't have a rand base currency which may mean that traders in South Africa will have to endure currency conversion costs when using it.

Additionally, conduct thorough research, evaluate user reviews, and compare the account with other options in the market to ensure it aligns with your specific needs.

Overall, the FBS Standard Account is undoubtedly a popular choice among traders worldwide, but it's essential to make an informed decision based on your individual circumstances.

By considering the features, advantages, and trading conditions of the account, you can determine whether it is the right choice for you. Happy trading!

Other FBS Accounts To Consider

FBS Cent Account

For beginners who want to risk low amounts and test strategies.

- $1 (R16) minimum deposit

- Trades and balances are shown in cents

- Leverage up to 1:1000 and zero commission.

FBS Pro Account

Ultimate account for large orders and algo trading by expert traders.

- $200 minimum deposit

- Low spreads & low margin requirements

- Upgraded VPS Service

- Up to 1:2000 leverage

Frequently Asked Questions On The FBS Standard Account

The FBS Standard account is a trading account offered by FBS, a reputable forex and CFD broker. It is designed to provide traders with access to a wide range of financial instruments and trading features.

The minimum trade size with the FBS Standard account is 0.01 lots. One lot equals 100,000 units of a base currency, so 0.01 lots account for 1,000 units of the base currency.

The minimum deposit is $1 (R16).

The Standard account offers leverage up to 1:3000

The spreads on the FBS Standard account are floating spreads, which means that they can vary depending on market conditions. However, the spreads are typically very competitive, starting from 0.7 pips.

No, there are no commissions charged on the FBS Standard account. This means that you can keep more of your profits.

You can use the FBS Standard account with MetaTrader 4, MetaTrader 5, and FBS Trader. This gives you a choice of platforms, so you can choose the one that best suits your needs.

The account supports the following trading instruments: Forex, metals, indices, energies, Forex exotic, stocks, and crypto.

Other Posts You May Be Interested In

How To Trade Forex Currencies On Deriv 📈

This article will show you how you can trade currencies on Deriv. Many Deriv clients [...]

Read MoreThe Powerful V75 Moving Average Buy Only Strategy

The V75 Moving Average Buy Only Strategy has an 80% success rate. The strategy is [...]

Read MoreDeriv Real Account Registration In South Africa (2024) ✅

This guide will walk you through the Deriv real account registration process step-by-step, so you [...]

Read MoreTop 5 Best Forex Brokers With Zar Accounts (2024) ✅

HFM (Formerly Hotforex) Best ZAR Account Forex Broker HFM is by far the best broker [...]

Read MoreThe Profitable NASDAQ Trading Strategy

This strategy will show you how to trade the Nasdaq index profitably. What Is Nasdaq? [...]

Read MoreHow To Become A Deriv Payment Agent & Make Money (2024) 💸

Learn how to register & become Deriv payment agent & earn commission while helping your [...]

Read More