Our FBS broker review takes a closer look at the features, benefits, and drawbacks of this broker to help you make an informed decision about whether it's the right choice for you.

What Is FBS Broker?

FBS Broker is a popular online trading platform that offers a range of financial instruments, including forex, stocks, and commodities. With a presence in over 190 countries including South Africa, FBS has become a well-known name in the world of online trading.

FBS is a fully regulated and award-winning international forex and CFD broker established in 2009 with headquarters in Belize and regional offices in Cyprus and the Marshall Islands.

The broker brings transparent conditions for trading and boasts of over 27 million happy clients. FBS is locally regulated under the FSCA.

FBS Broker Review At A Glance

| 🏅 Broker's Name | FBS |

| ⚖ Regulation | CySEC, ASIC, IFSC, FSCA, |

| 📅 Year Founded | 2009 |

| 💳 Minimum deposit | $1 for the cent Account & Standard Account, $200 Pro Spread Account |

| 🏋️♂️ Maximum Leverage | 1: 3000 |

| ☪ Islamic Account? | $1 for the cent Account & Standard Account, $200 Pro Spread Account |

| 💹 Types of assets traded | Forex, commodities, bonds, shares, indices, stocks, CFDs, metals, energies |

| 🧾 Supported lot sizes | 0.01 – 500 |

| 🎮 Demo account | ✔ Yes |

| 🗣 Languages supported on Website | Deutsch,English,Español,Français,Italiano,Português |

| 💸 Payment methods | Neteller; Sticpay; Skrill; Perfect Money |

| 💹 Is scalping allowed? | ✔ Yes |

| ♻ Are multiple accounts supported | ✔ Yes |

| 📂 Is PAMM supported | ❌ No |

| ⏬ Is CopyTrader supported? | ✔ Yes |

Is FBS Safe or Scam?

FBS is a safe, credible and trustworthy forex broker that has a high trust score of 90 out of 99. Through transparent client relations and its comprehensive 24/7 support team, FBS has built a steadfast reputation for reliability.

FBS is regulated by CySEC, ASIC, IFSA, and FSCA and it has negative balance protection making it a safe broker.

FBS Account Types

This FBS review found that the broker offers 3 account types to suit the needs of different traders.

FBS account types to choose from:

- FBS Cent Account – balances reflect in cents, offering traders a low-risk trading environment

- FBS Standard Account – provides traders with a more traditional and conventional trading experience

- FBS Pro Account – Ultimate account for large orders and algo trading by expert traders.

FBS Cent Account

This FBS broker review found that this account perfectly suits beginners who want to risk low amounts and test strategies.

| 📊 Account Type | FBS Cent Account |

| 💳 Minimum Deposit | $1 / R 16 ZAR |

| 💸 Floating spreads | From 1 pip |

| 💹 Commission | Zero-commission trading |

| 🏋🏾♀️ Leverage | 1:1000 |

| 📱 Platforms | MT4, MT5 |

| 🚀 Order volumes | from 0.01 up to 1000 cent lots, with 0.01 step |

| 🧾 Market execution | from 0.3 seconds, straight-through processing (STP) |

| ☪ Conversion option | Available to convert to Islamic Account |

You can compare the FBS Cent account with the HFM Cent account.

FBS Standard Account

This FBS account type is an ideal choice for traders of all levels seeking optimal conditions.

| 📊 Account Type | FBS Standard Account |

| 💳 Minimum Deposit | $1 / R 16 ZAR |

| 💸 Floating spreads | From 0.7 pips |

| 💹 Commission | Zero-commission trading |

| 🏋🏾♀️ Leverage | 1:3000 |

| 📱 Platforms | MT4, MT5, FBS Trader |

| 🚀 Order volumes | from 0.01 up to 500 lots, with 0.01 step |

| 🧾 Market execution | from 0.3 seconds, straight-through processing (STP) |

| ☪ Conversion option | Available to convert to Islamic Account |

FBS Pro Account

This FBS broker review found that the FBS pro account is perfect for expert traders who want to place large orders and use algo trading.

| 📊 Account Type | FBS Pro Account |

| 💳 Minimum Deposit | $1000 / R 16 000 ZAR |

| 💸 Floating spreads | From 0.5 pips |

| 💹 Commission | ❌ Commission-free trading |

| 🏋🏾♀️ Leverage | 1:2000 |

| 📱 Platforms | MT4, MT5 |

| 🚀 Order volumes | from 0.01 up to 500 lots, with 0.01 step |

| 🧾 Market execution | from 0.3 seconds, straight-through processing (STP) |

| ☪ Conversion option | Available to convert to Islamic Account |

You can compare the FBS Pro Account vs the HFM Pro account.

This FBS broker review found that the broker recently scrapped other accounts it used to offer namely:

- FBS Crypto Account

- FBS ECN account

- FBS Zero Spread account

- FBS Micro account

New traders will not be able to open these types of accounts anymore.

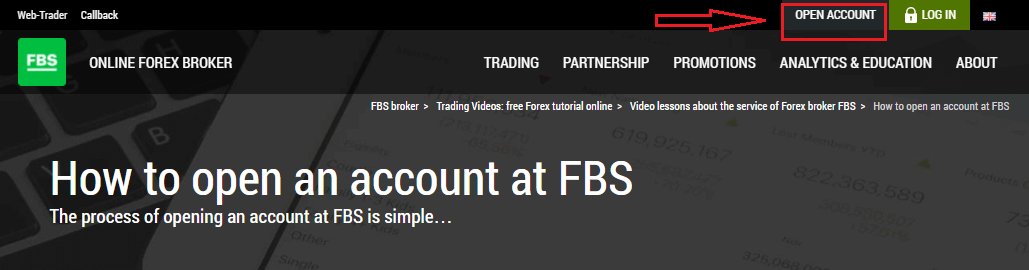

How To Open An FBS Trading Account: Step-By-Step

Our FBS broker review found that the process of opening an FBS account is simple and straightforward.

Time needed: 5 minutes

Follow these simple steps to open a trading account with FBS broker

- Visit the FBS Account Sign-up page

Go to the FBS real account registration page and click on the “Open an account” button in the top right corner of the website.

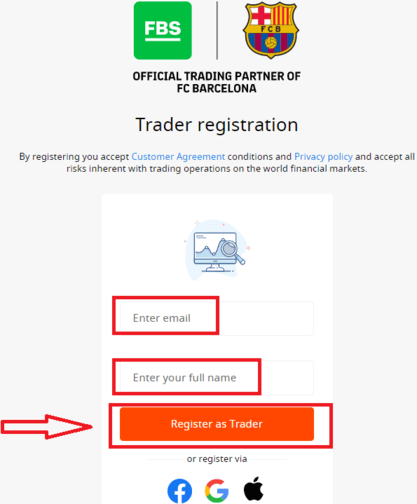

- Enter your details

Enter your valid email and full name. Make sure to check that the data is correct; it will be needed for verification and a smooth withdrawal process. Then click on “Register as Trader” button.

You can also register via social media but we do not recommend that unless these social media sites have your full name as it appears on your ID. - Confirm your email

An email confirmation link will be sent to your email address. Make sure you open the link in the same browser as your open Personal Area. The system will generate a temporary password. You can continue using it, but we recommend that you change it for enhanced security.

- Choose your FBS Account type

As soon as your email address is confirmed, you will be able to open your first FBS real or demo trading account.

You will need to choose an account type as FBS offers a variety of accounts.

If you are a newbie, choose the cent or micro account to trade with smaller amounts of money as you get to know the market.

If you already have Forex trading experience, you might want to choose standard, zero spread or ecn account - Download the platform that works for your device

This FBS review found that the broker offers MT4, MT5 and FBS trader platforms for trading. Choose your preferred platform and download it

- Save your login information

You will see your account information displayed after downloading your platform.

Make sure to save this information and keep it in a safe place.

Note that you will need to enter your account number (MetaTrader login), trading password (MetaTrader password), and MetaTrader server to MetaTrader4 or MetaTrader5 to start trading.

After doing these steps you would have successfully created your FBS live account.

FBS Spread Review

This FBS broker review found that you have the option to either trade with a spread starting from 1 pip or be offered one with a tight spread. The typical spread on the Standard account for the EUR/USD pair is 0.9, and on the Cent Account, the EUR/USD spread is 3 pips.

FBS Trading Fees

FBS charges overnight rollover fees (swap-free is available) and a cancellation fee of €5 for transactions that have taken advantage of price latency. Accounts dormant for 180 days are charged a €5 monthly fee.

These FBS fees are very competitive and attractive to traders.

FBS Minimum Deposit

This FBS review found that the broker offers a minimum deposit of just $1 / R16 on all its accounts except the Pro account which has a minimum deposit of $1000 /R16 000.

This makes the broker easily accessible for local South African beginner traders who can start without risking a lot of money.

FBS Minimum Withdrawal

The minimum withdrawal via e-wallets Perfectmoney & Skrill is $1 / R16 whole Sticpay has a minimum of $3 /R48.

Withdrawals via Bitcoin have a minimum requirement of $20

FBS Deposit & Withdrawal Methods

Our FBS review found that several deposit and withdrawal methods are available including, Visa, and electronic payment systems, such as Skrill, Neteller and PerfectMoney. You can also deposit and withdraw via Bitcoin.

Deposits are instant and no FBS does not charge for deposits except for Sticpay which charges a 2.5% and an additional $0.30 / R 4.80 ZAR commission.

Fbs Withdrawal Review

How long does FBS withdrawal take in South Africa?

Withdrawals from FBS in South Africa via e-wallets like Skrill and Perfectmoney take up to 30 minutes. Withdrawals via credit or debit cards take 3-4 business days.

FBS Withdrawal Fees: How much is it to withdraw from FBS?

Our FBS review found that the broker charges withdrawal fees as follows:

| 💳 Withdrawal fees – Credit/Debit Card | $1 / R 16 ZAR commission |

| 📉 Withdrawal fees –Neteller | 2% with a minimum commission of $1 / R 16 ZAR and a maximum of $30 / R 480 ZAR. |

| 📈 Withdrawal fees –Sticpay | 2.5% along with a commission of $0.30 /R 4.80 ZAR. |

| 📊 Withdrawal fees –Skrill | 1% along with a $0.32 / R 5.12 ZAR commission. |

| 💰 Withdrawal fees –Perfect Money | 0.50% commission. |

FBS Platforms

FBS offers the MT4 and MT5 platforms. This includes desktop, mobile and web versions. FBS also offers its own proprietary trading platform, FBS Trader.

Fbs Trading Review: Trading Assets

Our FBS trading review team found that clients can access a wide range of assets for trading including:

- Forex – 28 standard pairs plus 16 exotics

- Metals – four precious metals

- Energies – WTI and Brent crude oil

- Stocks (global only) – 40 US, 30 UK, and 30 German company shares

- Indices – a long list of cash-based indexes including the NASDAQ

- Cryptocurrency – Crypto trading is available via the FBS Trader app and the web-based Personal area. Cryptos can be traded directly and in a range of 35 pairs – crypto/crypto or crypto/fiat, such as BTC/USD and LTC/USD

FBS Review: Customer Support

This FBS review found that the broker has exceptional support. You will find FBS Customer Support available 24/7 accessible either through live chat, international phone lines, email or even social media.

Definitely, FBS stands at a quality support level which is always good and necessary throughout your trading process. FBS gives relevant and fast answers to concerns and questions and is marketed as a client-oriented broker.

FBS Response times:

| Support Channel | Average Response Time | User Based Response time |

| 📲 Phone | Few minutes | Instant to a few minutes |

| 24 hours | Within a few hours or less | |

| 🗣 Live chat | An hour | Instant to a few minutes |

| 💻 Social Media | Few minutes | Instant to a few minutes |

| 💰 Affiliate | Few minutes | Within a few hours or less |

FBS Review: Education

There are numerous educational materials and programs provided by FBS also that are designed to enhance the trading capabilities of its clients.

This is an especially good point for beginner traders, as firstly you should understand the industry well, practice strategy through Demo Account, which is available on an unlimited basis and then follows with Live trading.

At the FBS learning centre, you will find a range of Webinars, Forex Guidebooks, numerous Tips for traders, Video Lessons with Glossary materials. All in all, FBS education is quite sustainable and well organized, also you will find other good tools including research and analysis very important at any step of the trading career.

FBS Review: Pros & Cons

👍🏾Pros

- Low minimum deposit

- Well-regulated

- A range of account types

- Variety of educational material

- Responsive customer support

- Leverage up to 1:3000

- Offers deposit bonus

- Free demo contest

👎🏾Cons

- No Zar account

- No service to clients from USA, UK, Japan, Israel, Canada

- Does not offer copytrading

See FBS Alternatives

FBS Review: Conclusion

Our FBS trading review has shown that this is a regulated and safe broker that is very competitive in terms of its trading fees. The broker is trustworthy and credible as shown by the fact that 17 million people have chosen FBS to be their broker of choice globally.

FBS represents a brokerage company, which relies on fair-trading services and brings an opportunity to every trader no matter the level of expertise or even the size of investments.

The range of account types, platforms advanced tools, and convenient customer support prove this. Trading costs are average, and there is no misunderstanding in the market that FBS is a model company as an ECN Broker.

We recommend this as one of the best forex brokers in South Africa.

Frequently Asked Questions On FBS Review

FBS offers an ECN account to its clients.

FBS is a credible and trustworthy forex broker that has a high trust score. The broker is by CySEC, ASIC, IFSA, and FSCA

Yes, FBS accepts traders from South Africa.

Withdrawals from FBS in South Africa via e-wallets like Skrill and Perfectmoney take up to 30 minutes. Withdrawals via credit or debit cards take 3-4 business days.

Yes, FBS Broker is suitable for beginners as it offers a user-friendly trading platform and a wide range of educational resources.

Yes, FBS is regulated with the Financial Sector Conduct Authority (FSCA) as FBS Markets Pty Ltd under licence number 50885

The article is very easy to scan through because of how the information is presented. As someone who has used the broker, it is mostly accurate. However, there are a few things that have changed since. For instance, there is no copy trading service on the platform anymore.

Thanks for that. I will update the article soon.